2025 Year in Review

My yearly portfolio snapshot.

Overview

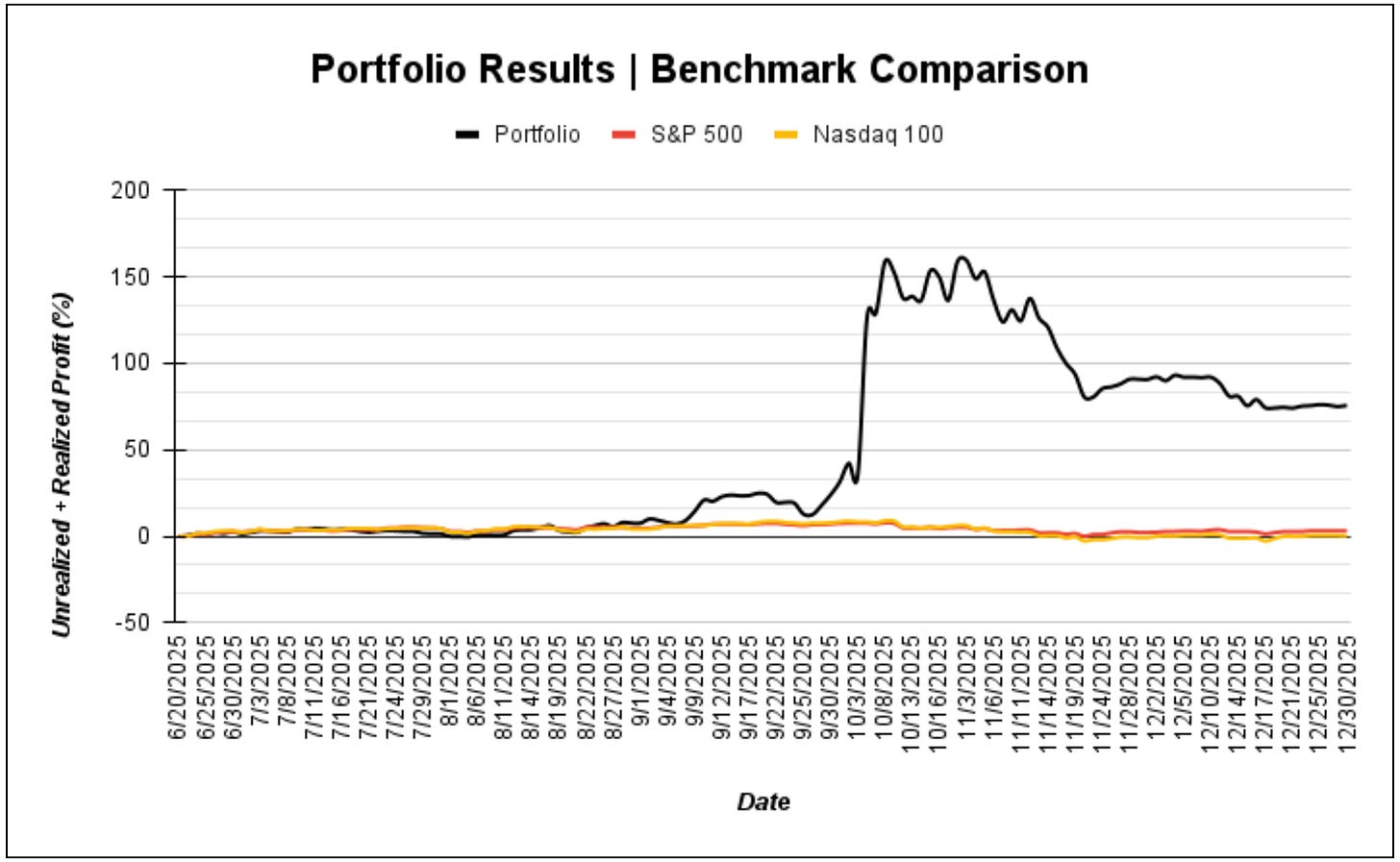

2025 was not a year of smooth, linear progress - and the equity curve reflects that reality. Markets spent much of the year rotating leadership, compressing ranges, and repeatedly testing patience. While broad indices finished strong, participation was uneven and timing mattered far more than theme selection. The environment consistently rewarded selectivity, risk control, and restraint, and punished forcing exposure during choppy or illiquid conditions.

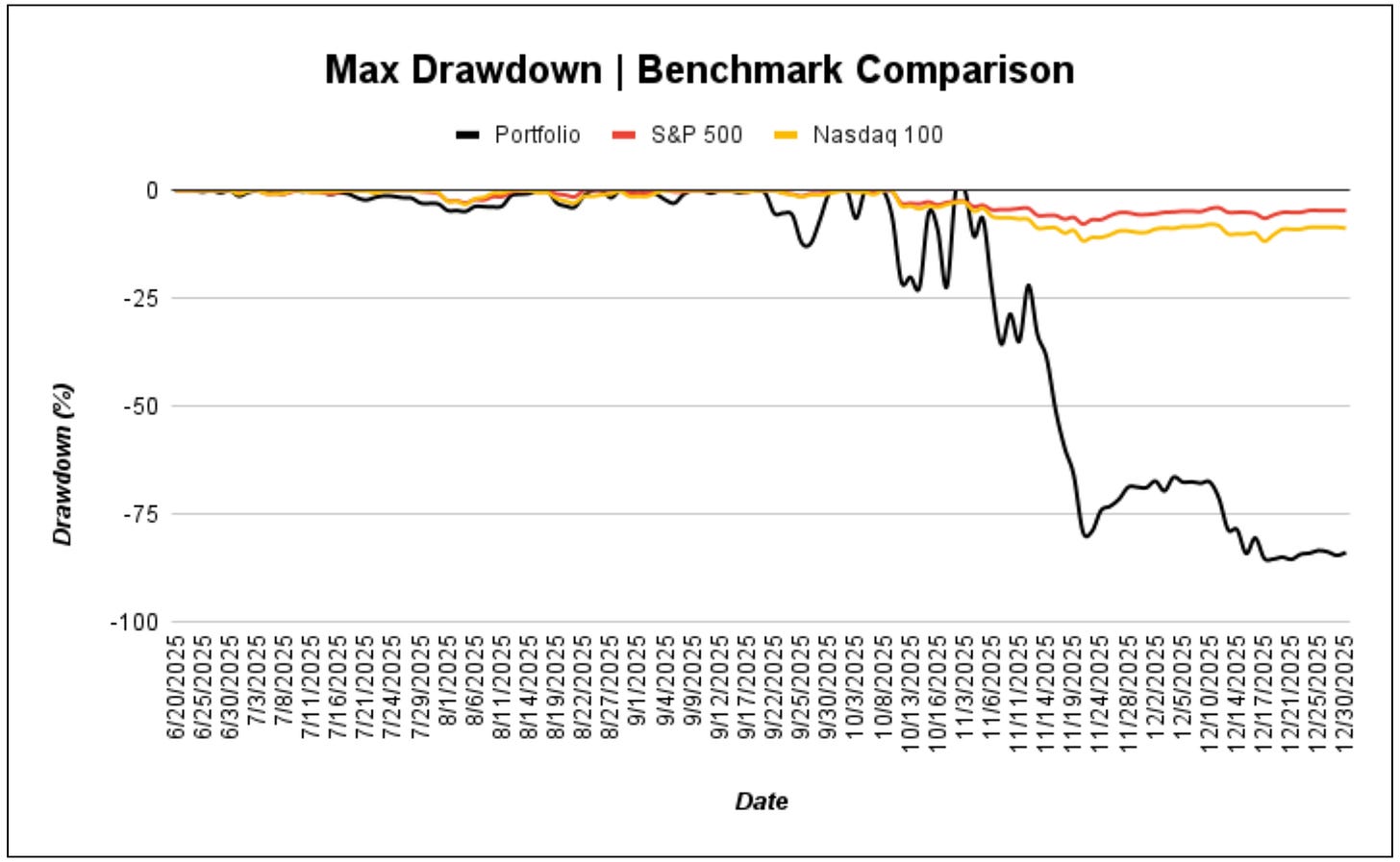

From a capital perspective, the year marked a transition from experimentation toward process maturity for me. Net liquidation value expanded meaningfully over the documented period, but the path was volatile, with sharp drawdowns and recoveries reinforcing the importance of position sizing, stop discipline, and knowing when not to trade. This was not a year where constant activity paid - it was a year where survival through difficult stretches enabled compounding later.

Process & Execution

Execution throughout 2025 followed a risk-first, asymmetric framework. Trades were entered with predefined invalidation levels, and positions that failed to confirm were exited quickly. This resulted in a low win rate by design, but losses were generally small and controlled, while gains were allowed to expand when leadership and structure aligned.

This approach led to volatility in the equity curve, but also allowed the portfolio to recover and grow once conditions improved. The ability to remain solvent and emotionally stable through drawdowns proved just as important as trade selection.

Best & Worst Outcomes

Top Name: AMD

AMD represented the strongest expression of the year’s dominant growth theme - AI and high-performance compute - and, more importantly, consistently behaved like a leader. As the broader semiconductor space rotated and chopped, AMD repeatedly held structure, absorbed volatility, and rewarded staying power rather than precise timing. It served as an example of how being in the right vehicle mattered more than constant repositioning.

Most Challenging Name: IBIT

IBIT highlighted the opposite dynamic. While crypto remained a high-profile theme throughout the year - supported by ETF adoption and renewed institutional interest - the execution environment was unforgiving. Volatility was extreme, follow-through inconsistent, and alignment with broader risk conditions unreliable. Despite a logical thesis, IBIT struggled to function as a stable exposure within a regime that repeatedly penalized high-beta, momentum-dependent vehicles.

Risk Management & What Changed

The defining characteristic of 2025 was capital preservation through discipline. Drawdowns were experienced, but they were survivable because risk was controlled at the trade level. Stops were honored, exposure was reduced when conditions deteriorated, and there was no attempt to “average down” invalid ideas.

As the year progressed, the framework tightened:

Fewer trades, higher standards

Greater emphasis on leadership confirmation

Clearer separation between interesting ideas and deployable risk

This evolution helped stabilize performance in the latter portion of the year and created a more repeatable foundation going forward.

Key Metrics

Metrics below reflect the documented trading period and are provided for transparency and process evaluation - not performance marketing.

Capital & Equity Curve

Total YTD Portfolio Return: +74.90%

Total YTD S&P 500 Return: +16.35%

Total YTD Nasdaq 100 Return: +20.16%

Equity Curve Profile: Volatile, recovery-driven, non-linear

Trading Activity

Closed Trades: ~30

Win Rate: ~35–40%

Average Holding Period: ~2–4 weeks

Loss Profile: Frequent small losses; strict stop discipline

Outcome Distribution: Highly asymmetric (few trades drove most gains)

Exposure Style: Selective, concentrated, single-name focused

Risk Characteristics

Periods of elevated drawdown followed by recovery

Volatility driven more by position concentration than trade frequency

Capital preservation prioritized over smooth returns

These metrics reflect a process designed to limit downside, preserve capital, and allow upside to compound when conditions are favorable.

Closing Perspective

2025 made one thing clear: long-term compounding starts with survival. The year rewarded patience, punished impatience, and reinforced that risk management is not something you add later - it is the strategy. The strongest outcomes came from staying aligned with true leadership, while the most difficult experiences sharpened discipline and improved decision-making.

As Knowlton Insights moves forward, the focus remains unchanged: deploy capital selectively, protect downside aggressively, and let the market dictate when risk is warranted - not the calendar.