Evidence Brief - 14 Nov 2025

A quantitative summary of market leadership, breadth, and positioning risk.

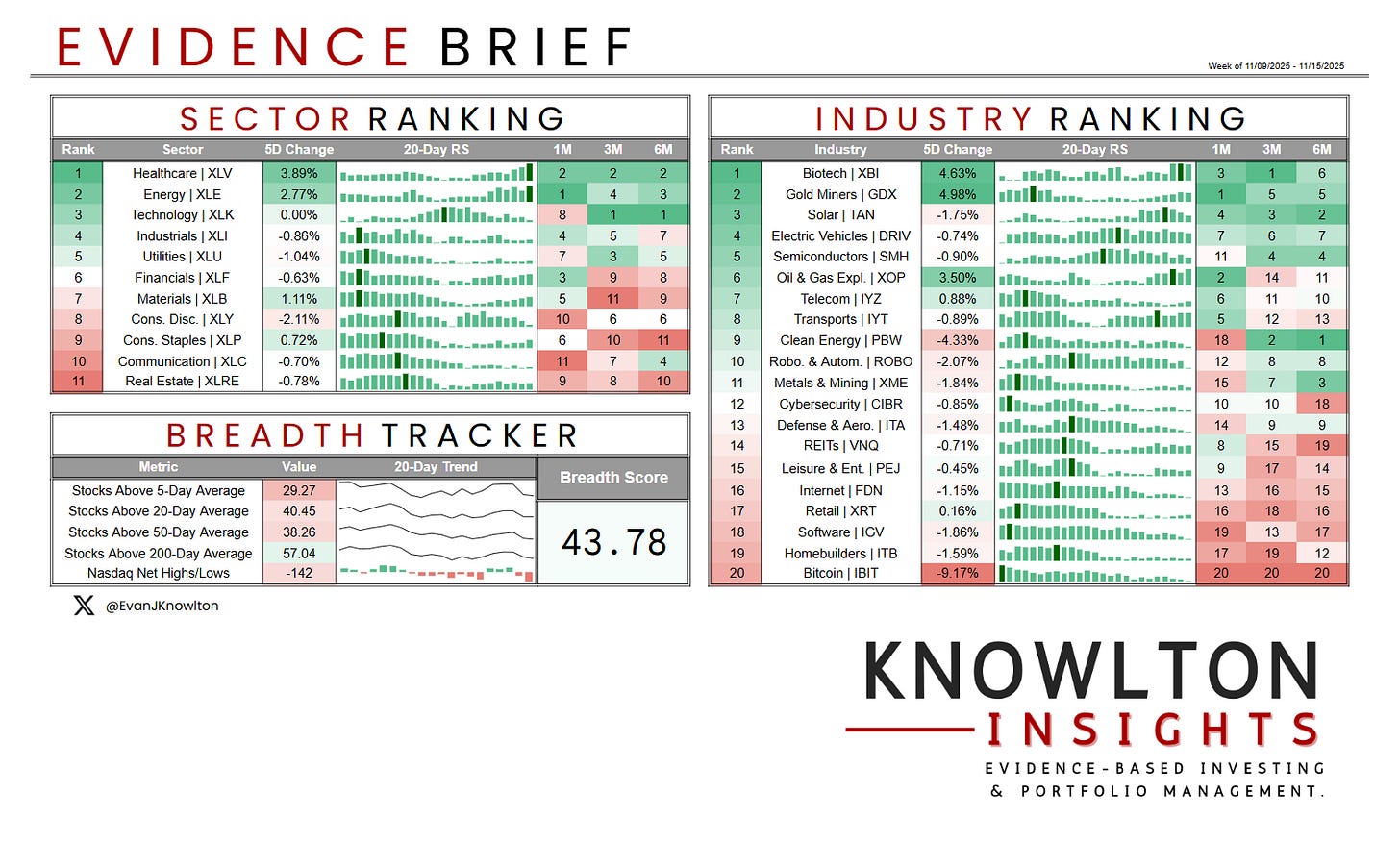

Regime check (weight of the evidence)

Breadth softened but did not break. 29.3% of stocks sit above their 5-day average and ~40% above 20/50-day averages, yet 57% remain above the 200-day. Nasdaq net highs/lows closed the week at −142 today - ugly, no doubt. The composite Breadth Score at 43.78 says “volatile uptrend digestion,” not a bear, but a yellow flag. Price action matched: violent intraday reversals, sharp swings around the 50-day, but no decisive break in the longer-term trend yet.

Leadership & flow

Sectors

Healthcare (XLV) is the clear #1 on the board with a +3.9% 5D gain and top-tier ranks across 1–6M.

Energy (XLE) is #2 with strong 5D performance and the best 1M rank, while still top-3 at 6M.

Technology (XLK) sits #3 short term but remains the dominant 3–6M leader (ranks 1/1)—classic “pause within leadership,” not a regime change.

Defensives (XLU, XLP) are mid-pack; Real Estate (XLRE) and Comm (XLC) are stuck at the bottom, confirming that “safety” and rate-sensitive stories are not where the real bid is.

Industries

Biotech (XBI) and Gold Miners (GDX) ripped to the top of the rankings with ~4.5–5% 5D gains and persistent 1–6M strength - speculative beta leading does not scream risk-off.

Solar (TAN), EVs (DRIV), and Semis (SMH) remain top-quartile even with choppy 5D returns, showing that innovation cyclicals are still where leadership clusters.

Clean Energy (PBW) is telling: short-term hit (weak 5D / 1M rank 18) but elite 3–6M ranks (2/1) - longer-term trend intact, near-term pain.

The bottom of the table - Internet (FDN), Retail (XRT), Software (IGV), Homebuilders (ITB), Bitcoin (IBIT) - confirms that “high-beta narratives” are getting punished when they’re not backed by real relative strength.

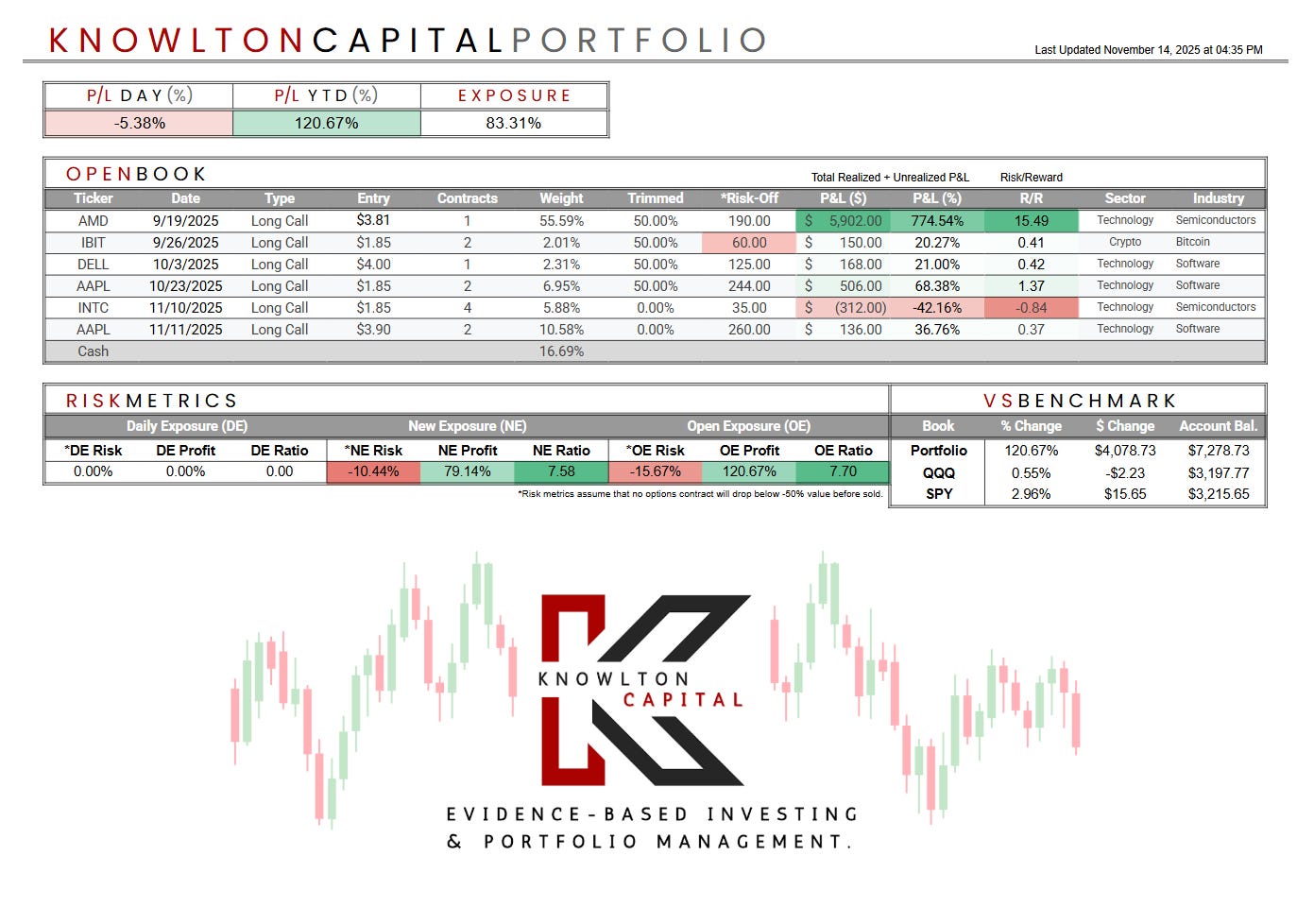

Where the crowd is mis-positioned (my read)

Still underweight “boring” leadership. Healthcare and select Energy names are doing the heavy lifting while most participants remain obsessed with mega-cap tech narratives. XLV’s position at the top of every timeframe is the tell.

Overstaying losers in story names. The destruction in names like TSLA this week is aligned with the bottom-tier industry ranks (Autos, Retail, some Internet/Software). The tape is ruthless toward anything that isn’t both strong and liquid.

Misreading volatility as trend failure. Internals >200-day are nearly 60% with a neutral Breadth Score. The week felt awful - large swings, gap downs, emotional whipsaws - but structurally, this still looks like a trend in digestion in leaders, not a top.

Positioning implications (how I’d run risk)

Core stance: Maintain modestly long bias with a quality tilt: XLK as core exposure, but respect that short-term momentum has rotated into XLV and XLE. This week’s tape argues for more balance between “growth leadership” and “defensive quality leadership.”

Satellite risk:

Priority longs: SMH, TAN, DRIV, XBI and GDX on strength days - these represent the intersection of innovation and macro flow.

Treat PBW and other lagging-but-strong 3–6M groups as buy-the-dip candidates, not core holdings; use smaller size and tighter timeframes until they prove higher again.

Trim/avoid:

De-emphasize XLC, XLRE and the bottom-ranked industries (XRT, ITB, IBIT). The evidence says these are where capital goes to die right now.

Emotionally expensive names that violate key levels (my TSLA experience) should be cut without debate - if they aren’t leading in your portfolio rankings, they have no right to be oversized in the book.

Options overlay:

Keep call spreads in satellites until breadth pushes decisively higher.

Reserve outright long calls or larger stock positions for names that sit in top-5 industry ranks and are above rising 20/50-day MAs.

Risk triggers & playbook for next week

De-risk:

If % >50-day falls back under 35% and Nasdaq net highs/lows print ≤ −75 for 2+ sessions, cut satellite exposure by one tier and reduce single-name risk to ≤1% per idea.

Re-risk:

If Breadth Score > 60 with % >50-day > 55% and net highs/lows flip to +50 or better, step back into full size in the strongest sectors (XLV, XLK, XLE) and top-ranked industries (XBI, GDX, SMH, TAN).

Process:

This week’s noise was a live-fire test of my framework: stick to the ranking + breadth combo and treat emotional swings as a contrary indicator. The job is not to feel good about every day’s P&L; the job is to stay aligned with the evidence while weak hands get shaken out.