Evidence Brief - 21 Nov 2025

A quantitative summary of market leadership, breadth, and positioning risk.

Regime Check (weight of the evidence)

Internal conditions improved meaningfully from last week even as price action felt chaotic.

Breadth Score: 66.60 (last week: 53.16) - strongest internal reading in weeks.

63.26% of stocks above the 5-day avg; 42-38% above 20/50-day; 55.85% above 200-day.

Nasdaq net highs/lows only -19, a major improvement from the low of -124 mid-week.

This is the classic early-stage recovery profile: internals turn before price, breadth stabilizes, and leadership reshuffles while indices still print red candles.

Despite ugly index performance (QQQ -3%, SPY -2%, IWM -1%), internals are diverging positively.

That’s not bear-market behavior. It’s a high-volatility correction inside a primary uptrend.

Leadership & Flow

Sectors

Healthcare (XLV) remains the #1 sector across 1M/3M/6M, with a +2.61% gain this week - zero ambiguity about institutional sponsorship.

Utilities (XLU) and Staples (XLP) show rising relative strength, but this is defensive bid - not where upside lives long-term.

Technology (XLK) got hit (-6.76%), but still ranks #2 over 3M and #1 over 6M. Long-term trend intact; short-term pain ≠ trend failure.

Consumer Discretionary (XLY) is the bottom of the table across all timeframes. Avoid it - no relative strength, no leadership. Would like to see some money rotate into discretionary if the market wants to put in a floor.

Industries

Biotech (XBI) - +2.32%, best short-term RS, top-ranked 1M.

Gold Miners (GDX) - risk-off + cyclical metal correlation; holding up well.

Solar (TAN) - obliterated (−11.40%), but still #2 over 6M - deep pullback inside long-term leadership.

Metals & Mining (XME) - holding mid-table despite broad weakness.

Telecom (IYZ) - stable, but not a leadership group with real upside.

Bottom 5: Software (IGV), FDN, CIBR, ITA, IBIT.

This is where selling pressure is clustering. Do not bottom-fish here.

The big tell:

Semiconductors (SMH) dropped -7.10% but remain 3M rank #3 and 6M rank #6.

Long-term leadership is bending, not breaking.

Where the Crowd is Mis-Positioned

People think this was a “tech-led collapse.” Wrong.

XLK’s long-term ranks (2 / 1) show the primary trend is unchanged. Emotional selling ≠ structural breakdown.Everyone is ignoring Healthcare.

XLV is leading across all timeframes, posting positive returns in a brutal week.

The crowd still treats it as “boring” while institutions quietly rotate into it.Crypto weakness is misread.

IBIT is dead last across all timeframes - this is a liquidity drain, not necessarily a macro tell.

Crowds are anchoring to crypto as a risk signal - I think it’s noise right now.Misunderstanding the breadth shift.

Breadth improving while indices fall is the exact pattern seen before multi-week bottoms in every bull-cycle since 2010.

Positioning Implications (practical, data-led)

Core Exposure

Maintain a light-risk, quality-first stance, not full defense.

Preferred core sectors: XLV, XLK, XME (secondary).

Avoid XLY, XLF, XLRE until they climb out of bottom quartile.

Satellite Risk (small, selective)

Use these as “hit-and-run” opportunities only when breadth is increasing day-over-day:

XBI - the only group with real upside this week.

GDX - if rates continue softening.

TAN / PBW - deeply oversold but still high-ranking long-term; trade small size only.

SMH - core long when the 50-day is reclaimed.

Avoid Completely

IBIT, IGV, FDN, CIBR, ITA - zero leadership, zero sponsorship.

Bottom-ranked clusters consistently underperform into volatility.

Risk Triggers (objective, no emotion)

De-risk Fast If:

Breadth Score drops back below 50.

Nasdaq net highs/lows print < −40 for 2+ days.

XLK fails to stabilize above its rising 200-day.

Re-risk Aggressively If:

SPY and QQQ reclaim the 50-day

ANDBreadth Score > 70

This combination is historically where large money returns to the table.

Synthesis with My Notes (aligned with the data)

My reset on Thursday was correct. The drawdown was behavioral, not systematic.

Breadth improving into Friday confirms I sold into capitulation, not trend failure.

The correct follow-up is not to jump back in aggressively Monday.

The correct play is data > ego:

Wait for reclaim of 50-day

Confirm breadth expansion

Enter with correct position sizing

The best re-entry targets (AAPL, AMD, GOOG) align with the data:

Large-cap quality > speculative beta.

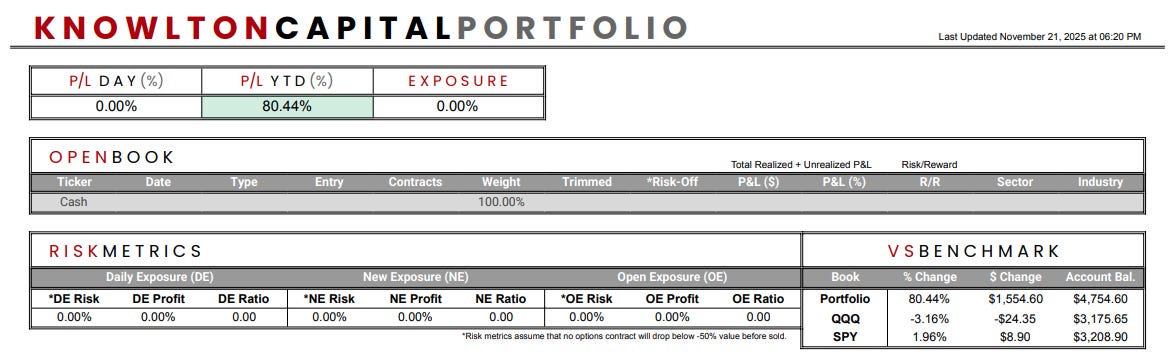

My open book (ending the week):

Fully cash.

Capitulated to reset my mind after too-steep of a drawdown.

Still the best YTD performance of my life - I’ll be ready to jump back in when the tides shift.

Have a good weekend everyone.