Evidence Brief - 28 Nov 2025

A quantitative summary of market leadership, breadth, and positioning risk.

Regime check (weight of the evidence)

This week was a textbook breadth thrust.

Breadth Score: 100.00 - maxed out.

85% of stocks are above their 5-day, 67% above 20-day, 53% above 50-day, and 61% above 200-day moving averages.

Nasdaq net highs/lows at 50+ for 3 days straight confirm real expansion, not a narrow squeeze.

Structurally, this is what the early phase of a powerful leg higher in a bull market looks like: internals firing on all cylinders, small caps and cyclicals participating, and volatility receding while bears are still anchored to last week’s pain.

Leadership & flow

Sectors

Healthcare (XLV) stays the undisputed leader: +3.49% on the week and ranked #1 over 1M and 3M, #2 over 6M.

Communication (XLC), Utilities (XLU), Staples (XLP), and Materials (XLB) all posted strong 5D gains between ~2–4% and sit in the top half of the momentum stack.

Technology (XLK) gained +2.33% and still holds #2 / #1 ranks over 3M/6M despite being short-term laggy (1M rank 11). Long-term trend leadership remains intact.

Discretionary (XLY) ripped +5.32% but still carries a mid-pack composite profile (1M/3M/6M ranks 10/5/4) - strong, but not the primary anchor yet.

The takeaway: defensive + growth leadership together = early-acceleration phase after a correction, not late-cycle distribution.

Industries

Top of the stack:

Biotech (XBI) +7.56%, ranked #1 in 1M and overall - genuine risk-on.

Gold Miners (GDX) +8.95%, #2 across 1M/3M - metals trade is alive.

Metals & Mining (XME) +6.31%, with elite 6M rank (#2).

Semiconductors (SMH) +3.78%, 1M/3M/6M ranks 12/4/6 - not the hottest on a 1M basis but still core long-term leadership.

Homebuilders (ITB) +10.75% - violent upside with improving but still mixed longer-term ranks.

Clean Energy (PBW), Retail (XRT), ROBO, and Transports (IYT) all had 4–7% weeks and sit mid-to-upper tier in the 3–6M stack.

Bottom:

Software (IGV), CIBR, FDN, IBIT remain at the bottom of the rankings despite small positive weeks. This is where rallies are least trustworthy.

Where the crowd is mis-positioned

Still trading last week’s crash, not this week’s data.

Most traders are anchored to the drawdown and “psychological damage.” Breadth hitting a perfect 100 while sentiment is still washed out is the exact opposite of what late-stage tops look like.Underweight Healthcare + Biotech + Metals.

XLV, XBI, GDX, XME are obvious leadership by any objective ranking system. Yet the crowd is still arguing about NVDA headlines and crypto squeezes.Chasing discretionary pops without respecting longer-term structure.

Discretionary, retail, and homebuilders had huge weeks, but their 3–6M ranks are only now starting to repair. They’re buyable - but not at the size people are rushing into if they’re ignoring where real, sustained leadership already exists.Treating this as “just a bounce.”

With SPY/QQQ back above key MAs, a broad thrust in participation, and small caps leading, the burden of proof has shifted. The default now is “trend resumption higher” unless breadth suddenly collapses.

Positioning implications (how I’d run risk)

Core book

Core sectors: XLV, XLK, XLC, XLB.

Tilt size toward XLV + XLK as dual anchors: healthcare as steady leadership, tech as secular trend.

Equal weight or underweight: XLF, XLI, XLE until their ranks improve relative to the leaders.

Satellites / offensive risk

Use small-to-moderate size satellites in:

XBI, GDX, XME - first tier; they combine strong short-term performance with established 3–6M strength.

SMH, PBW, XRT, ITB, ROBO, IYT - second tier; aggressive beta with improving structure. Use options or reduced size to respect volatility.

Stay highly selective with TAN, DRIV and any single-name high beta; use them only when they align with both industry rank and your setup rules.

Avoid / minimize

IGV, FDN, CIBR, IBIT - persistent bottom-quartile names. If you must trade them, they are rentals, not investments.

Risk triggers & playbook

Stay offensive as long as:

Breadth Score stays ≥70 and % >50-day stays above 45%.

Nasdaq net highs/lows remain positive and don’t collapse back below zero for more than a day or two.

SPY and QQQ hold above their 20-day MAs, with 50-day MAs turning back up.

De-risk if:

Breadth Score falls back below 60 and % >50-day drops under 40%.

Leaders like XLV, XLK, XBI, SMH all undercut their 20-day MAs together.

Credit spreads start widening sharply again (check HYG vs. Treasuries as confirmation).

In that case, you simply step back to core XLV/XLK exposure and cut satellites in half.

Synthesis with my notes

The Monday “selective and patient” stance matched the data: breadth was turning but not yet thrusting.

By Tuesday and Wednesday, the evidence noted - SPY reclaiming the 50-day, equal-weight indexes bouncing, sentiment still crushed - is now fully confirmed by this week’s 100 Breadth Score and broad leadership surge.

Treat last Friday as the low, this week as the thrust, and next week as the window to press, provided breadth doesn’t immediately roll over.

The edge now isn’t in predicting a bottom - it’s in exploiting the fact that the market already printed one while most people are still arguing about whether it’s “real.”

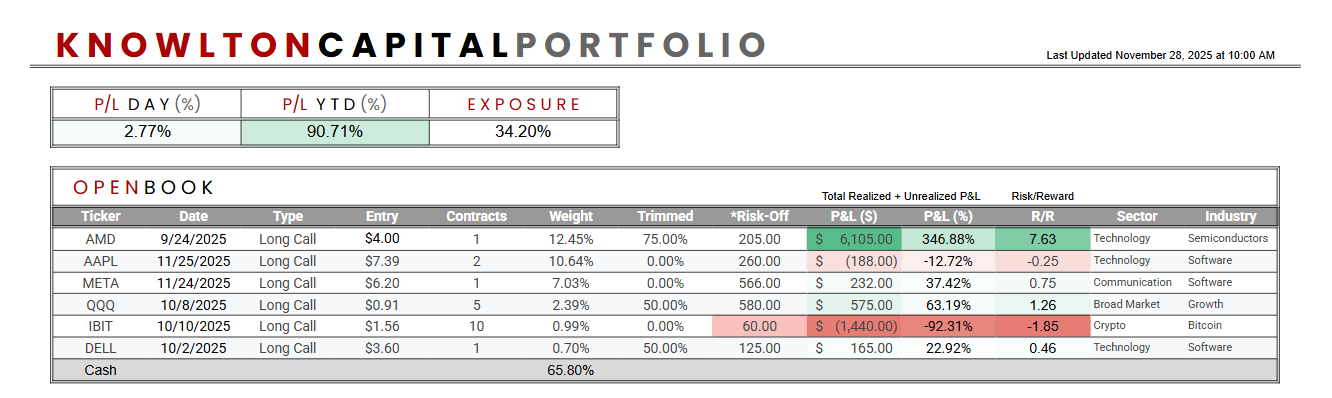

My open book (ending the week)

Made a pretty big step in my journey this week.

I am controlling my dad’s account now, which is why there is a portfolio of positions here compared to none last week.

He had taken every trade I did this year, so P/L YTD (%) is still accurate as well as overall positioning, however there is some cleaning up to do (ex. IBIT).

Only moves made this week were the addition of META and rolling out AAPL to a further expiration using short-term profits.

I mentioned last week that I would be ready to jump back in when the tides shift higher again.

Well, they are shifting.

And I am ready.

Have a good weekend.