Evidence Brief - 5 Dec 2025

A quantitative summary of market leadership, breadth, and positioning risk.

Regime check (weight of the evidence)

The market is firmly in risk-on mode.

My Breadth Score: 100.00 again - internals are maxed out.

67.3% of stocks above their 5-day, 72.9% above 20-day, 57.5% above 50-day, and 63.1% above 200-day moving averages.

Nasdaq net highs/lows at +87 confirm a persistent expansion in new highs.

Small caps ripping, equal-weight indices breaking higher, VIX compressing, credit spreads rolling over. This is what a persistent thrust inside a secular bull looks like, not a tired top.

Short-term, the one risk factor is crowded optimism (put/call reset, speculative pockets running hot). But the weight of trend, breadth, volatility, credit, and seasonality all argue for staying on offense with risk controls, not fading the move.

Leadership & flow

Sectors

Technology (XLK) is back on top: +2.44% on the week, and ranked #4 / #2 / #1 over 1M/3M/6M. It’s still the primary secular leader.

Consumer Discretionary (XLY) and Communication (XLC) follow, each up ~2.5–2.6% with top-tier 1M ranks (#2 and #1).

Healthcare (XLV) pulled back −3.47% but still holds #1 / #2 ranks over 3M/6M - a cooling leader, not yet a broken one.

Financials, Industrials, and Energy are solidly mid-pack; Utilities and Real Estate sit at the bottom of the stack.

Net: growth + cyclicals (XLK, XLY, XLC) are in charge, with XLV still a structural leader despite a bad week.

Industries

Top of the table:

Metals & Mining (XME) +7.37%, 1M rank #1, strong 3M/6M ranks (6/4).

Clean Energy (PBW) +6.75%, 3M/6M ranks 3/1 - secular leader with renewed momentum.

Biotech (XBI), ROBO, GDX, SMH, XRT, IYT, DRIV all post 3–7% weeks and sit mostly top-half over 3–6M.

Homebuilders (ITB), XOP, TAN give you a cyclical/energy/solar sleeve with improving but more mixed longer-term ranks.

Bottom: FDN, CIBR, VNQ, IGV, ITA, IBIT remain lowest in the composite stack even with small bounces - structurally weak.

Where the crowd is mis-positioned

Still underestimating how powerful this thrust is.

Two consecutive weeks with great breadth and positive net highs while small caps and risk-on sectors lead is not “late stage” - it’s the expansion phase most people miss because they’re anchored to the last drawdown.Anchored to old defensives.

Investors who hid in Utilities, Staples, and Real Estate during the selloff are now lagging badly. XLK/XLY/XLC plus cyclicals like XME/PBW/SMH are where compounding is happening; XLU/XLRE are dead money.Chasing random story names instead of structured leadership.

ARKK/crypto pops get all the attention, but the consensus is clear: the Metals + Clean Energy + Biotech + Semis combo is the more durable leadership cluster.

Positioning implications (how I’d run risk)

Core book

Overweight:

XLK as the primary core. This is a tech-driven bull market and that has not changed.

Secondary core:

XLV despite the weekly drawdown - keep it in the mix; pullbacks in leaders are opportunities.

Offensive satellites

Focus on the clusters that show both strong recent moves and solid 3–6M ranks:

Metals & Energy Transition: XME, PBW, GDX.

High-beta growth: SMH, XBI, ROBO, XRT, DRIV, IYT.

Options expression:

In more speculative sleeves (PBW, DRIV, ARKK-type themes), stick to defined-risk spreads; breadth is strong but sentiment is getting hot.

Avoid / underweight

FDN, CIBR, VNQ, IGV, ITA, IBIT as structural underperformers. Trade them only as short-term rentals if they line up perfectly; they shouldn’t be core capital sinks.

Risk triggers & playbook

Stay aggressive while:

Breadth Score remains ≥80 and % >20-day stays above 60%.

Nasdaq net highs/lows stay positive and above +40.

XLK/XLY/XLC all hold above their 20-day moving averages near highs.

De-risk quickly if:

Small caps (IWM) begin to roll over together while VIX spikes back above 20.

Credit spreads re-widen (check HYG/LQD vs Treasuries) - that’s the macro “enough is enough” signal.

In that case, you cut satellites, fall back to a lean core (XLK + XLV), and wait for the next breadth expansion.

This is a clear, statistically favorable risk-on window with seasonal and macro tailwinds. Your job now is simple: press into structured leadership with proper size with preserving the year of gains this market has provided.

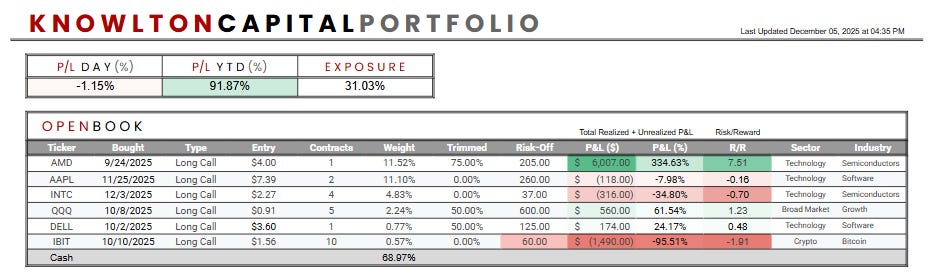

My open book (ending the week)

I added INTC calls this week and sold META, looking to roll the profits out to a later expiration when the time is right.

Watching ORCL, AMD above ~225, GOOG, MU, and U. Everything I want to own is starting to line up.

Overall: the market is confirming the thesis that last week was a major low. I’m staying selective, but it’s time to start leaning back into strength little by little.