The market welcomed October with surprising resilience, as the Nasdaq climbed steadily throughout the week despite early volatility.

Monday’s opening gap higher set an optimistic tone, though initial gains faced resistance as the session progressed.

By Tuesday, we witnessed an impressive reversal after an intraday sweep of Monday’s low, culminating in strong closes at the day’s highs, a powerful signal to end September.

Wednesday proved particularly telling when markets opened lower on government shutdown concerns but rallied back impressively to close at session highs.

This strength carried into Thursday morning with the Nasdaq touching all-time highs before experiencing some profit-taking.

Friday brought the expected NFP-related hesitation, closing the week on a quieter note after multiple attempts to break through to new record territory.

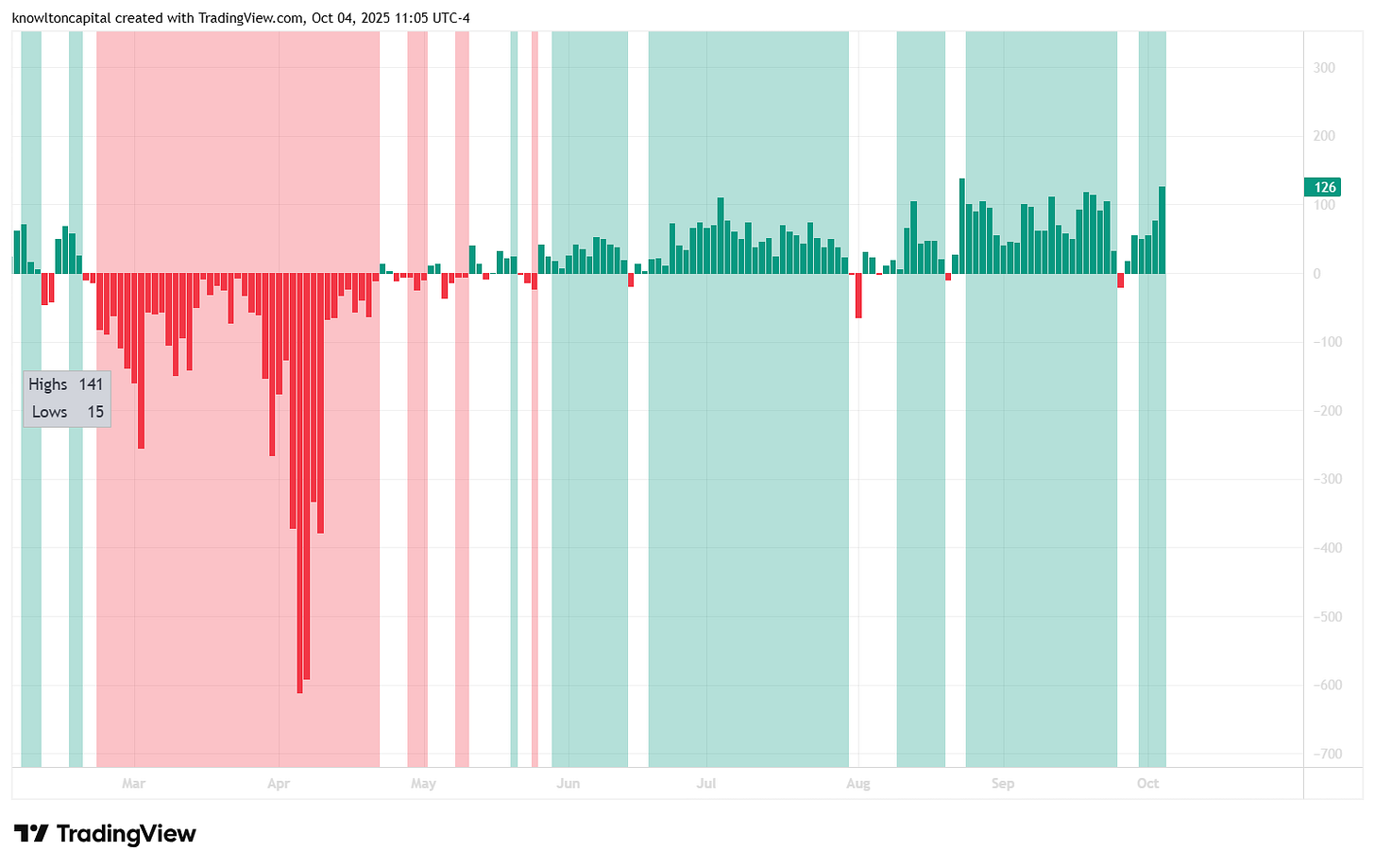

Market breadth continued to improve throughout the week with net new highs expanding consistently, and rather rapidly:

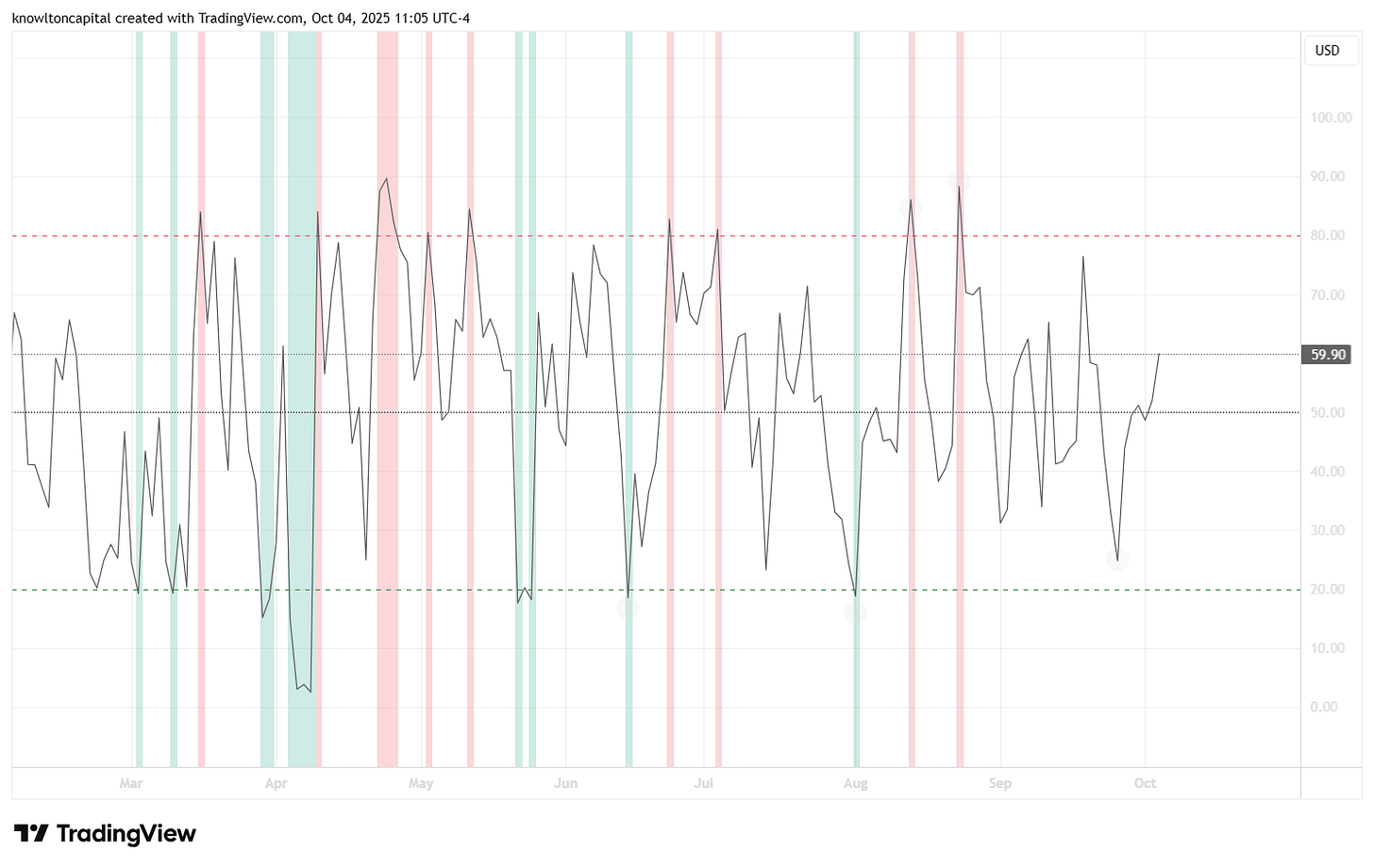

The percentage of Nasdaq stocks trading above their 5-day moving averages remained in neutral territory, suggesting there’s still room for this rally to extend if momentum continues into next week:

Portfolio Highlights

IBIT emerged as the week’s standout performer, beginning Monday with a decisive gain and continuing its upward trajectory throughout the week. Bitcoin demonstrated remarkable strength this week, potentially setting up for further gains during October, historically it’s strongest month.

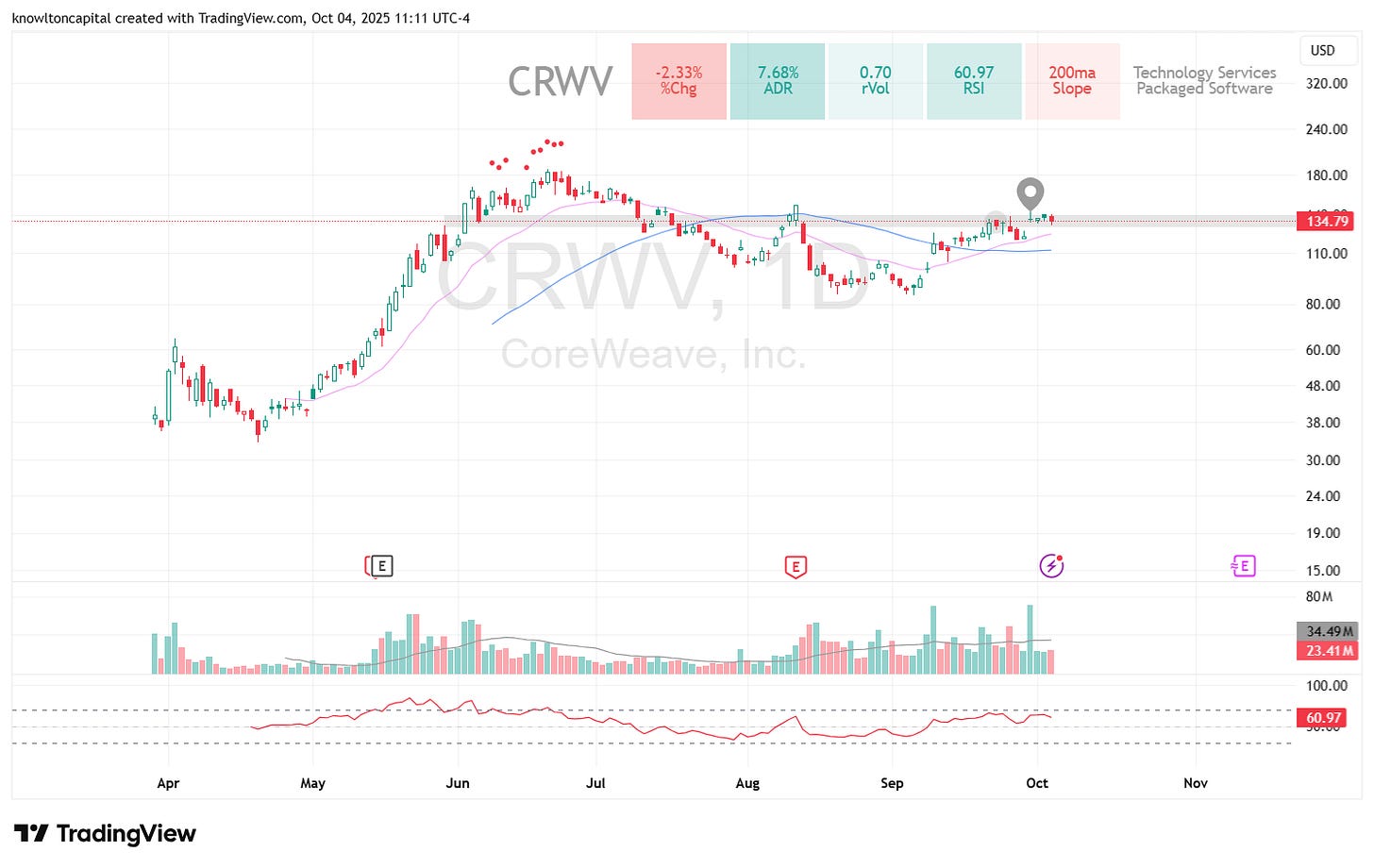

CRWV delivered unexpected excitement Tuesday, gapping higher on news of a significant META partnership that pushed the stock above the key $135 level. While it experienced some consolidation afterward, this position transformed from a portfolio laggard back to even in a single session and looks ready to resume higher.

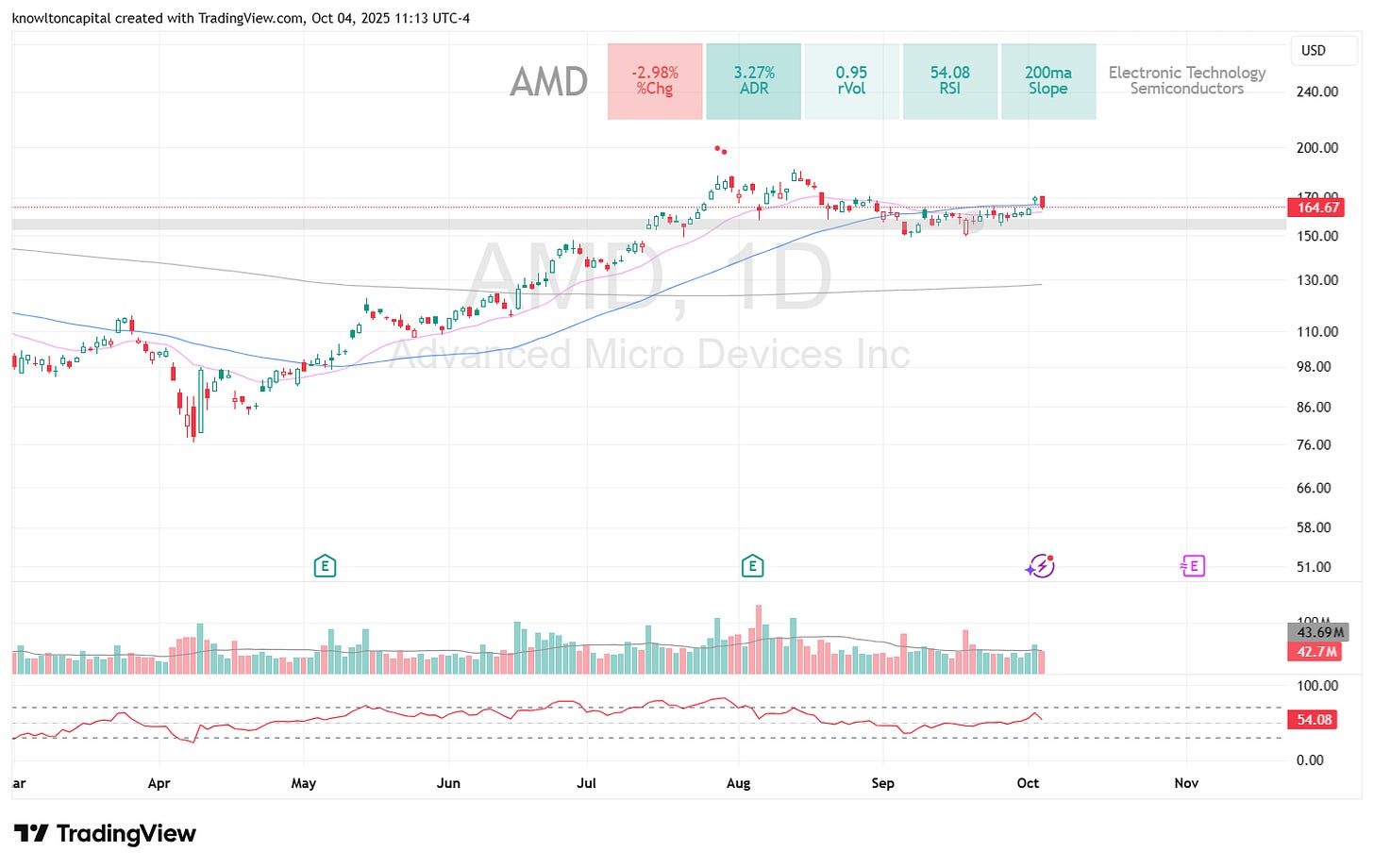

AMD finally broke out of a month-long consolidation pattern on Wednesday and Thursday, bursting through the important $165 level with impressive relative strength even as the broader market faded. Though there was some give-back on Friday, this textbook contraction-expansion move validated the patience required during the previous two weeks of tight ranges and looks set for higher prices.

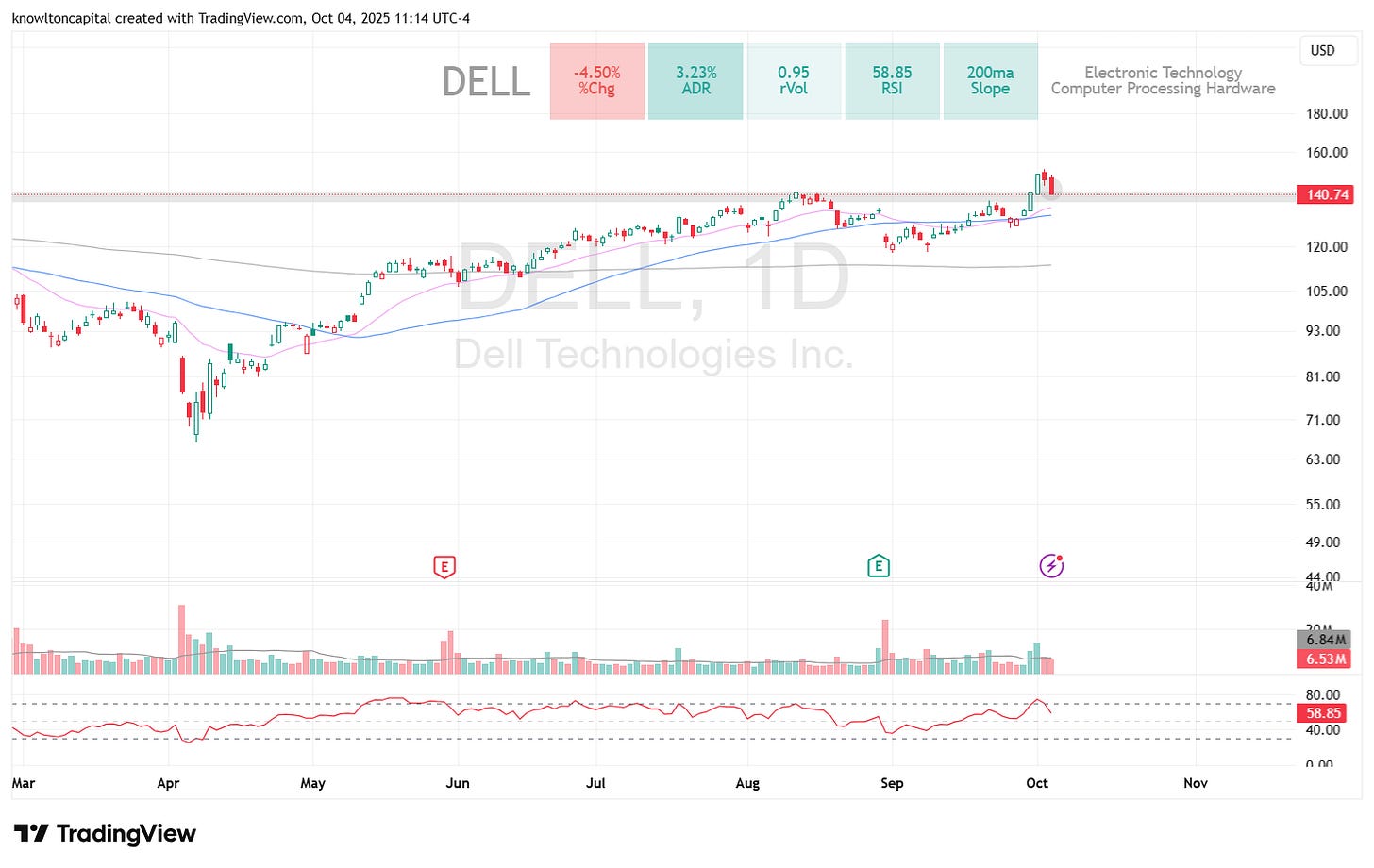

A late-week addition of DELL faced immediate headwinds Friday as tech stocks broadly retreated, though the lower volume suggested this was more profit-taking than significant selling pressure.

Market Movers Worth Watching

Several stocks outside the current portfolio demonstrated compelling action worthy of attention.

INTC continued its impressive ascent throughout the week, a name that appears poised for potentially significant upside that unfortunately remained on the watch list rather than in the portfolio.

QS decisively cleared the critical $15 level by Friday, showing remarkable strength against the backdrop of a weaker market.

TSLA presented an interesting setup after Thursday’s bearish engulfing candle, potentially offering a tactical buying opportunity on any continued weakness.

BE surged Tuesday on partnership news, while ALAB showed promising technical recovery, trading back into its 20-day moving average after recently testing the 50-day support.

Bottom Line

The market’s ability to climb despite uncertainty surrounding government funding suggests underlying strength entering October. With breadth expanding and many focus names showing constructive price action, the stage appears set for continued upside, though managing risk remains paramount as stocks approach extended territory in a historic intermediate uptrend.