Weekly Review: 10/6/25 - 10/10/25

Market Shifts Sharply as Major Indices Hit New Highs and End with Steep Selloff

The market started the week hovering near all-time highs, continuing the “melt up” grind with breadth and net highs expanding.

After initial optimism, defensives caught a bid on Tuesday as major indices pulled back.

Wednesday brought a strong rebound, led by tech, with the Nasdaq and other major indices closing at record levels once again.

By Thursday, markets slipped modestly while most sectors mixed, and on Friday, a sharp reversal hit tech and crypto hardest, ending the week with a steep, broad-based selloff.

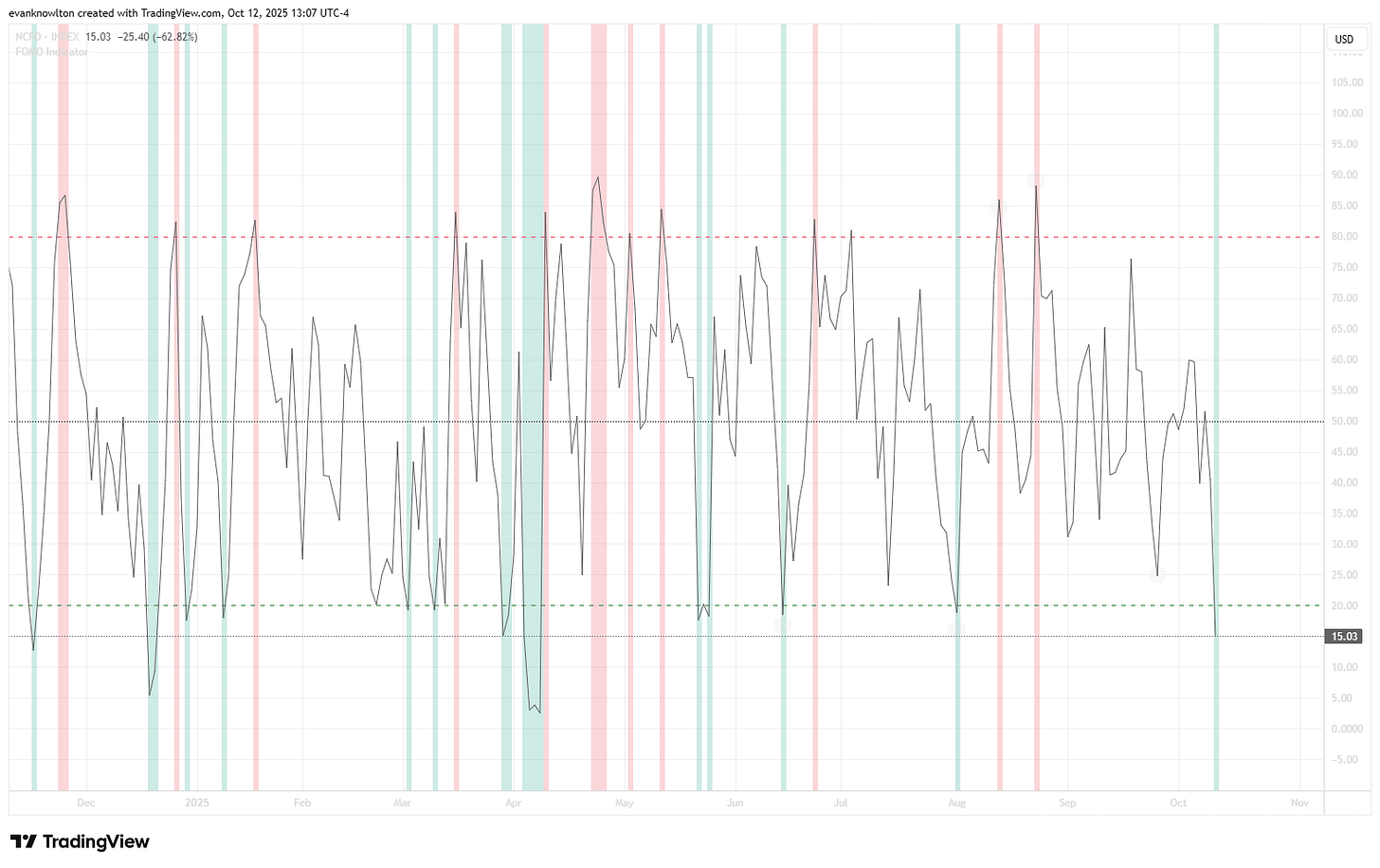

Throughout, key indicators like NFCD held neutral and breadth stayed robust until late in the week, suggesting there’s still the potential for momentum to return quickly if sentiment shifts:

Portfolio Highlights

AMD emerged as the week’s standout performer, soaring 30% on an OpenAI partnership announcement Monday, this became the best trade on my books this year, with partial profits locked early and a runner left on with exposure into March of next year.

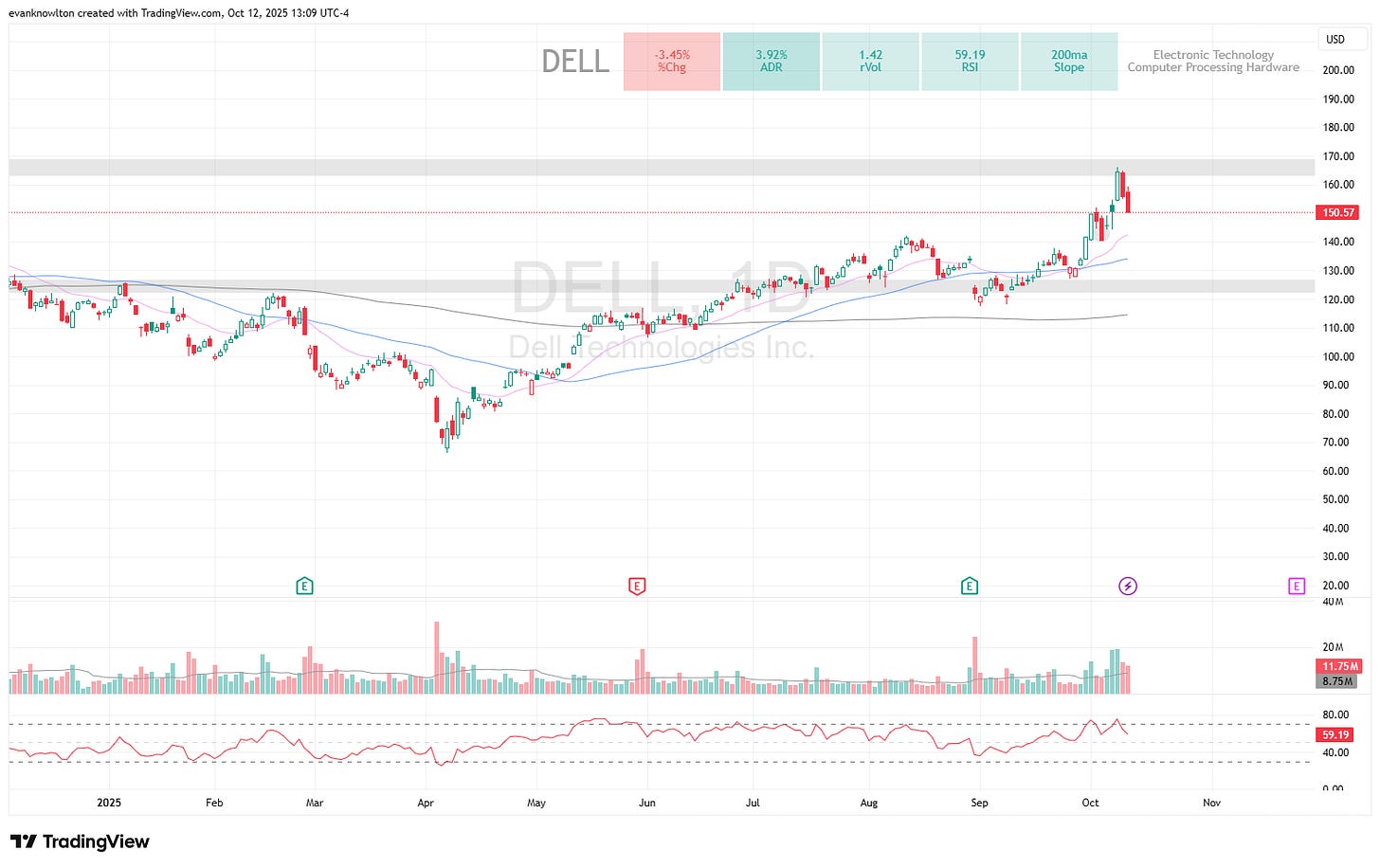

DELL staged a powerful move, notching new 52-week highs Tuesday following positive revenue guidance through 2030, and allowed for quick scaling out at 100% gain before reversing late week.

IBIT continued its trend early in the week, pressing into fresh highs before profit-taking set in; the pullback remained orderly until Friday, when the entire crypto market was hit hard after-hours. I will not be closing any trades on IBIT (already a free position), but I will likely be managing ETHA, as I will talk about shortly.

ETHA was added via January contracts around the 20EMA after options cooled, offering a steep entry discount. Depending on Monday’s action, I will close if it can’t get back above the clear support level around $30 after Friday’s selloff.

CRWV held above key levels midweek, finally rallying with Thursday’s close but faded into Friday with the rest of tech.

Market Movers Worth Watching

INTC continued its impressive ascent, standing out with strength Tuesday as most growth stocks lagged.

TSLA flashed strength out of last week’s weakness, then pulled back, potentially setting up tactical entries on additional dips.

Bottom Line

The market’s ability to push to new highs in the face of early-week resistance, then absorb a rapid reversal, underscores both resilience and risk amid a historic uptrend.

With net highs and internal breadth strong until Friday’s turn, the stage is set for volatility into next week.

Managing position size and risk levels remains vital as both opportunity and headline-driven risks accelerate in this tape.

Short-term trends are highly susceptible to manipulation, but two things remain clear: the primary trend is up (until the evidence shifts), and we are still risk-on.